Asset Turnover Ratio Increase Means

Average inventory represents the average amount of inventory over two or more accounting periods. Interpretation and Importance of Asset Turnover Ratio.

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

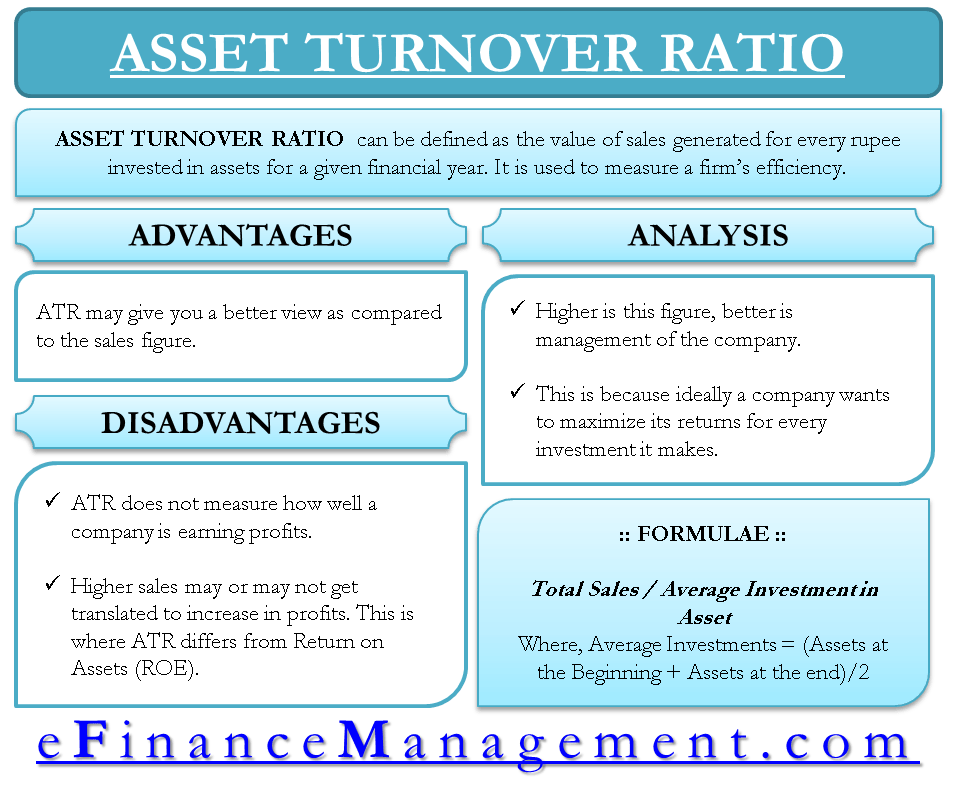

Asset turnover ratio measures the value of a companys sales or revenues generated relative to the value of its assets.

. Average inventory is the mean value of inventory throughout a certain period. The asset turnover ratio is a measurement that shows how efficiently a company is using its owned resources to generate revenue or sales. Since asset turnover ratio uses the value of a companys assets in the denominator of the formula to determine the value of a companys assets.

This indicates a slight decline in firms ability of generating sales through its current assets such as. The Asset Turnover Ratio is a metric that measures the efficiency at which a company utilizes its asset base to generate sales. Inventory Turnover ratio Cost of Goods Sold CoGSAverage Inventory.

It is best to plot the ratio on a trend line to spot significant changes over time. It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue. Asset turnover ratio is the ratio between the value of a companys sales or revenues and the value of its assets.

The ratio compares the companys gross revenue to the average total number of assets to reveal how many sales were generated from every dollar of company assets. Also compare it to the same ratio for competitors which. Enter your name and email in the form.

Is it better to have a high or low fixed asset turnover. The average net fixed asset figure is calculated by adding the beginning and ending balances then dividing that number by 2. In the retail sector an asset turnover ratio of 25 or more could be considered good while a company in the utilities sector is more likely to aim for an asset turnover ratio thats between 025 and 05.

For instance an asset turnover ratio of 14 means youre generating 140 of sales for every dollar of assets your business has. The time frame can be adjusted for a shorter or longer time. For example inventory is one of the biggest assets that retailers report.

Year 2 witnessed a slight decrease of firms current asset turnover ratio from 510 to 503 comparing to year 1. The total asset turnover calculation can be annually per year although it can be calculated otherwise. Total Sales Annual sales total.

However for a company the value to aim for ranges between 025 and 05. The asset turnover ratio is calculated by dividing net sales by average total assets. The Asset Turnover ratio can often be used as an indicator of the.

The higher the asset ratio the more efficient. The formula for total asset turnover can be derived from information on an entitys income statement and balance sheet. Your asset to turnover ratio is the percentage of your total assets that are turned over each year.

If a retail company reports a low. Therefore this ratio indicates how efficiently the company generates sales with every rupee invested in its assets. The higher the ratio the better is the companys.

Asset Turnover Ratio 333. The formula is as follows. As a quick example the companys AR balance will grow from 20m in Year 0 to 30m by the end of Year 5.

What is considered a good fixed asset turnover ratio. Net sales Total assets Total asset turnover. Current Asset Turnover Year 2 3854 766 503.

Thus asset turnover ratio can be a determinant of a companys performance. The calculation is as follows. Ending Assets Assets at end of year.

For example if you have 100000 in total assets and 1 million in annual sales your asset to turnover ratio would be 1001 million or 10. Beginning Assets Assets at start of year. To calculate it divide your total assets by your annual sales.

The inventory turnover ratio also known as the stock turnover ratio is an efficiency ratio that measures how efficiently inventory is managed. How to Calculate Your Ratio. The asset turnover ratio is essential for the company to understand how it can maximise its returns for every investment.

Based on the given figures the fixed asset turnover ratio for the year is 951 meaning that for every one dollar invested in fixed assets a return of almost ten dollars is earned. The inventory turnover ratio is calculated using a mathematical equation. In the retail business when the value of the total asset turnover ratio exceeds 25 it is considered good.

Each of the current assets will increase by 2m.

Turnover Ratios Definition All Turnover Ratios Uses Importance Efm

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

Asset Turnover Ratio Formula Meaning Example And Interpretation

No comments for "Asset Turnover Ratio Increase Means"

Post a Comment